Disclosure: This is a sponsored post. All opinions are my own.

Figuring out your finances can be tough. My husband and I spent our first years of marriage digging out of the debt we created from the carefree years of being single and clueless. When we finally reduced our debt to a manageable level, we needed to figure out what we wanted to do with the meager earnings we now were able to use for more than paying debt and buying ramen noodles.

We sought the advice of friends and family, but often found that they were just as clueless as we were. Luckily, we were able to get the financial help we needed and are better educated now but there is always room to learn more.

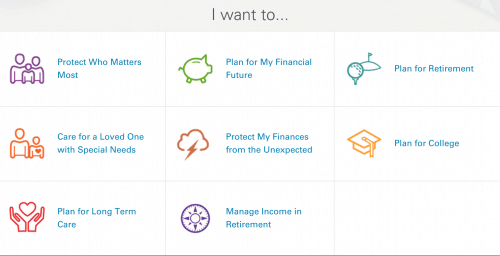

During Financial Literacy Month this month, Massachusetts Mutual Life Insurance Company is offering advice on ways to better understand your finances and secure your financial future for you and your loved ones. Some of the things you will learn – how to identify your short and long-term goals, making a budget, or talking to a financial professional. To get started, visit the new MassMutual website. It is full of tools, calculators, videos, and articles to help increase your financial IQ.

Are you worried about college expenses or whether or not you will have enough money for retirement? If so, then try out the college savings calculator and Retirement Planning Calculator to see what steps you should take to secure your future.

Check out these 6 ways that MassMutual can help you increase your financial smarts and reach your short- and long-term goals.

- Identify your financial goals.

How can you start a savings plan if you don’t know what you’re tracking toward? Set goals! Once you have an understanding of your goals, you’ll be able to take the next steps to achieving them. - Get organized.

Create a simple budget tracker to map out your income, expenses and any savings efforts you currently have in place. This will help identify risks and opportunities that you can address in the future, and can be the beginning of your financial strategy. - Use tools to help you project your savings needs.

Whether it’s calculating how much you need to save for your child’s college tuition or planning for your retirement, look for calculators online to help you. - Consider your most valuable asset and how it affects your future.

Your home? Your business? Your ability to work? What is your most valuable asset? Have you considered your income and how it affects your well-being? Exploring options like disability insurance can go a long way to ensure your families protection. - Teach your kids early.

Simple and fun activities can get them excited about saving for the future – like setting up a short-term savings plan with a personal piggy bank, and encouraging them to add to it when they have money to spare, from birthdays, allowances or loose change around the house. - Find the right people to help you.

When it comes to your finances, you need a strong team to assist you with important information and decisions. Working with a financial professional will help keep you on track and informed.

Sometimes taking small steps with your finances can make the biggest difference.

What are some of your best tips to save money for retirement and college?

Disclosure: This is a sponsored post written by me on behalf of MassMutual.

Speak Your Mind